If you’re a small business owner, you’ve probably heard about passthrough entity tax – but what is it?

Benefits of the PTET

The PTET allows business owners to pay state taxes through their business and receive a credit for the tax paid on their individual return. It doesn’t change the amount of state tax owed by the owners, it just changes how you pay it. Since it doesn’t change the tax owed, what is the benefit for the taxpayer? Why would you do it?

The IRS allows you to take state payments as a deduction, so essentially, this is a way for you to get an additional tax deduction at the federal level by paying your state taxes through your business. This is a deduction you wouldn’t get if you paid your state tax directly through your individual account. At the end of the day, you are paying less in federal tax.

Who Qualifies

Not everyone can benefit from the PTET. Only those with pass through entities like partnerships, LLCs or S-corps may make the election.

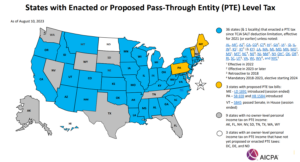

Who qualifies can also vary by state. According to American Institute of CPAs, 36 states have some version of the election, so check your state for your PTET elections and rules.

Limitations of the PTET

Even though the PTET can be beneficial for some, not everyone who is eligible for PTET payments benefits from making this election. There is a minimum amount you have to pay for a PTET election and some who are eligible actually owe less than that minimum. If you owe less and still make a PTET election, you are effectively over-paying your taxes.

And PTET payments are not refundable. Once you pay, you cannot get that money back. Instead, the overpayment rolls over to the following year. To make use of that money, you have to make the PTET election again the following year. This essentially locks you into a cycle of overpayment and keeps those funds trapped. The only way to get out of this cycle without taking a loss is if your income improves in the following years and you owe more than that minimum.

This cycle is most common for taxpayers who have multiple businesses. If one business underperforms and pulls down their overall income, that lowers what they owe in state tax for the year. This can also happen if the taxpayer is married and their spouse has a business that underperforms.

Tax planning is the best way to avoid falling into this trap. Check out the other benefits of a good tax plan here.

PTET Election in California

To make a CA PTET election in California, you must make the minimum payment by June 15th of every year. This payment must be 50% of your PTET payment from the previous year or $1,000, whichever is higher. If you miss the first payment date, you can’t make the election for the year.

There are no exceptions to the deadline. Once you make the election and complete your first payment, you can’t cancel the election. You must complete the payments and move forward with the election. Every state is able to set their own parameters, so this may be slightly different in your state. Make sure to check your state requirements.

It’s a No Brainer

If your personal state tax rate is the same or greater than the PTET rate for your state, making the election is a no brainer. To make sure you’re able to get the maximum benefits, discuss the election with your accountant. At Encurio, PTET planning comes standard with our client’s yearly tax planning.

If you’re a business owner who hasn’t been informed of the PTET before or you think you need help utilizing these tax savings, set a meeting with us to see how we can help!